GBP Growth Fund

The GBP Growth Fund is a Great British Pound denominated fund employing an active asset allocation strategy and a passive investment management strategy invested 15% in income assets (international fixed interest), with 85% exposure to growth assets (listed property and international equities).

Investment Objectives

The fund seeks to track composite indices (before annual fund charge and tax), comprising: 11% Bloomberg Global Aggregate Corporate Index, 100% hedged to GBP; 4% Bloomberg Global Aggregate Float Adjusted and Scaled Index, 100% hedged to GBP; 7% FTSE EPRA/NAREIT UK Index; 58.5% MSCI World ESG Screened Index Net GBP; and 19.5% FTSE Developed Index.

Underlying Fund Managers

The table below sets out the target asset allocation and underlying investment managers for the Fund.

For more information you can access the Funds Statement of Investment Objectives and Policy (SIPO).

|

Asset Class |

Underlying Fund Manager |

Underlying Fund | Benchmark Asset Allocation 1 |

|

International fixed interest |

iShares ESG Screened Global Corporate Bond Index Fund Class D Vanguard Global Aggregate Bond UCITS ETF |

15% | |

|

Listed property |

BlackRock Asset Management Ireland Limited | iShares UK Property UCITS ETF | 7% |

|

International equities |

iShares Developed World ESG Screened Index Fund Class D Vanguard Global Aggregate Bond UCITS ETF |

78% | |

| Total assets | 100% | ||

1 The Benchmark Asset Allocation, Maximum, Currency Hedging and Operating ranges are set out in the SIPO.

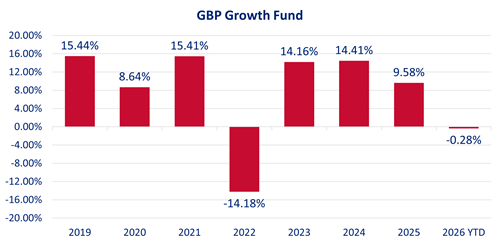

Fund Performance

See the below performance figures for the GBP Growth Fund as at 31 January 2026. The returns are after fees and after taxes:

|

PIR Tax Rate |

Month |

Quarter |

12-months |

3-Year |

5-Year |

Inception |

|

28% |

-0.28% |

-1.09% |

6.07% |

11.11% |

7.28% |

8.38% |

|

0% |

-0.19% |

-0.82% |

7.27% |

12.36% |

8.47% | 9.57% |

* GBP Growth Fund was established on 24 December 2018

* Returns for periods longer than one year are annualised

The chart below shows the fund return after fund charges and tax (at 28%) for each full calendar year the fund has been in existence. The last bar shows the performance of the current calendar year to date (1 January 2026 to 31 January 2026).

Product Disclosure Statement

Download the PDS for more information about Garrison Bridge.

This is a replacement Product Disclosure Statement for the Garrison Bridge Superannuation Scheme.