Market Commentary

November market commentary

In the US, the longest government shutdown in history finally came to an end. A messy backlog of delayed data trickled out, painting a picture of an economy losing puff: rising unemployment, weakening retail sales, and a notable slide in consumer confidence. Investors promptly revived their favourite hobby of betting on rate cuts. But jitters persisted, especially around tech valuations and liquidity: a reminder that nothing ruins a party quite like turning on the lights.

Third quarter corporate earnings provided some light relief. More than 80% of S&P 500 companies beat expectations, the highest rate in four years, with overall earnings growth sneaking into double figures. Nvidia had another blockbuster quarter, though investors struggled to get celebrations off the ground amid concerns that this was another sign of reckless overspending on AI.

We weren’t immune to offshore nerves at home. The mood wasn’t helped by unemployment creeping up to 5.3%, slowing wage growth, and the relentless rise of grocery bills. Still, the Reserve Bank delivered again, taking the OCR to its lowest in three years. This, plus a relatively upbeat reporting season, had investors flashing a little more cash in a late-month rebound.

Markets across the pond were also weighed down by the global tech selloff, exacerbated by a resilient jobs market and hotter-than-expected inflation which all but destroyed hopes of another rate cut in the foreseeable. A brief mid-month rally failed to stick as miners, gold stocks, and banks all took turns dragging performance lower.

Against this backdrop, the S&P 500 finished November ‘up’ 0.1%, while the tech-focused Nasdaq fell by 1.5%. The NZX 50 slipped 0.5% lower over the month, while the ASX 200 lost a chunkier 3.0%.

The FTSE 100 ended November exactly where it started, a respectable achievement in a month where the Chancellor unveiled £26 billion in tax hikes and officials downgraded growth forecasts. More encouragingly, inflation eased slightly to 3.6%, fuelling hopes that borrowing costs would follow a similar trajectory.

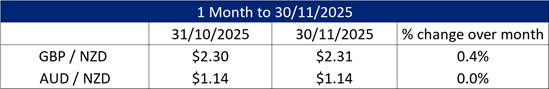

GBP and AUD / NZD exchange rate change from 31 October 2025 to 30 November 2025:

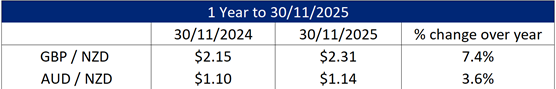

GBP and AUD / NZD exchange rate change from 31 October 2024 to 30 November 2025:

Monthly Summary - November 2025

Monthly Summary - October 2025

Monthly Summary - September 2025

Monthly Summary - August 2025

Monthly Summary - July 2025

Monthly Summary - June 2025

Monthly Summary - May 2025

Monthly Summary - April 2025

Monthly Summary - March 2025

Monthly Summary - February 2025

Monthly Summary - January 2025

Monthly Summary - December 2024

Monthly Summary - November 2024

Monthly Summary - October 2024

Monthly Summary - September 2024

Monthly Summary - August 2024

Monthly Summary - July 2024

Monthly Summary - June 2024

Monthly Summary - May 2024

Monthly Summary - April 2024

Monthly Summary - March 2024

Monthly Summary - February 2024

Monthly Summary - January 2024

Monthly Summary - December 2023

Monthly Summary - November 2023

Monthly Summary - October 2023

Monthly Summary - September 2023

Monthly Summary - August 2023

Monthly Summary - July 2023

Monthly Summary - June 2023

Monthly Summary - May 2023

Monthly Summary - April 2023

Monthly Summary - March 2023

Monthly Summary - February 2023

Monthly Summary - January 2023

Monthly Summary - December 2022

Monthly Summary - November 2022

Monthly Summary - October 2022

Monthly Summary - September 2022

Monthly Summary - August 2022

Monthly Summary - July 2022

Monthly Summary - June 2022

Monthly Summary - May 2022

Monthly Summary - April 2022

Monthly Summary - March 2022

Monthly Summary - February 2022

Monthly Summary - January 2022

Monthly Summary - December 2021

Monthly Summary - November 2021

Monthly Summary - October 2021

Monthly Summary - September 2021

Monthly Summary - August 2021

Monthly Summary - July 2021

Monthly Summary - June 2021

Monthly Summary - May 2021

Monthly Summary - April 2021

Monthly Summary - March 2021

Monthly Summary - February 2021

Monthly Summary - January 2021

Monthly Summary - December 2020

Monthly Summary - November 2020

Monthly Summary - October 2020

Monthly Summary - September 2020

Monthly Summary - August 2020

Monthly Summary - July 2020

Monthly Summary - June 2020